BUILD CREDIT

Stellar Fi

A cost-effective option that reports to two credit bureaus. While it might not cover all three bureaus, it’s a great budget-friendly choice. With most loans, you get the funds right away after approval. But with a Credit Builder Loan, you receive the money at the end of the loan term. Think of it as a savings adventure – your payments are held in a savings account until the term is up.

Credit Strong

Chime is a flexibly secured card where you can submit a deposit based on what is affordable for you. A Chime account can be a great addition to the credit-building toolkit. It offers a secure online banking platform and even has features like early direct deposit. It’s a modern approach to managing money and building credit.

Grow Credit

You Know What’s Awesome? Being Able To Turn Regular Rent Payments Into A Credit-Building Opportunity. With Rent Reporting, You Can Add Monthly Rent Payments To Your Credit Report, Highlighting Yet Another Positive Aspect Of Your Financial History. The Best Part Is Boom Will Pull In Up To 2 Years Of History. This Helps Those With Limited Age On Their Credit Reports. For Some, This Can Add Up To 40 Points To Credit Scores.

Credit Builder Credit Card

Sign up for Credit Score Pro’s affiliated Secured credit card from Credit Builder Card. No hard credit inquiry, just a check to ensure you’re not in an active bankruptcy process. Plus, when you apply through Incite Strategies, the sign-up and process fees are waived! Eager to start your credit journey? Click below to explore your secured credit card options and pave the way to a stronger credit score:

Experian Boost

Talk about innovation! Experian Boost lets you add your utility and telecom bills to Your credit report. You can even add subscription services like Netflix, Hulu and more. Those regular payments that typically go unnoticed can now contribute to a better credit score. It’s a simple way to showcase your responsible financial behavior. And best of all, your credit report is updated instantly!

The Self Credit Builder Account

This is a fantastic option for those who are looking to build credit and save money at the same time. If you are missing a mix of installment and revolving accounts You may see a benefit from Self. It even offers a secured credit card once $100 is saved. This allows you to build installment and revolving history impacting almost every factor that makes up your credit score.

Kikoff

A cost-effective option that reports to two credit bureaus. While it might not cover all three bureaus, it’s a great budget-friendly choice. With most loans, you get the funds right away after approval. But with a Credit Builder Loan, you receive the money at the end of the loan term. Think of it as a savings adventure – your payments are held in a savings account until the term is up.

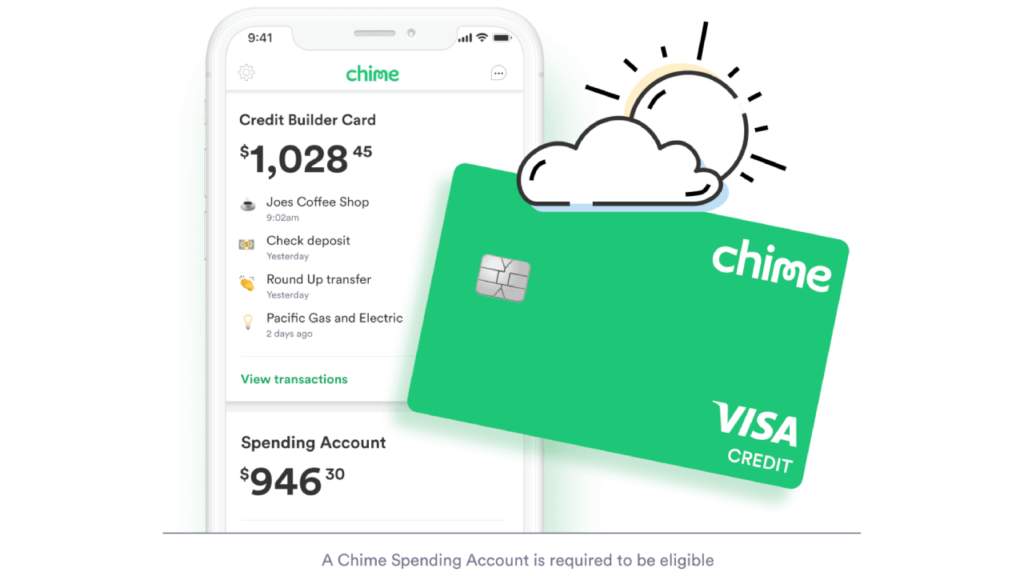

Chime

Chime is a flexibly secured card where you can submit a deposit based on what is affordable for you. A Chime account can be a great addition to the credit-building toolkit. It offers a secure online banking platform and even has features like early direct deposit. It’s a modern approach to managing money and building credit.

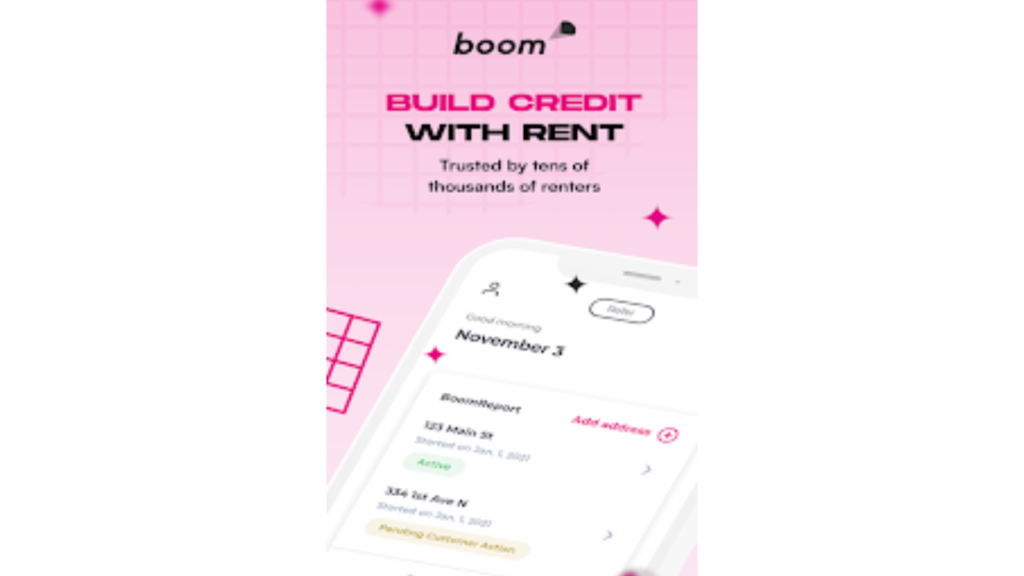

Boom Rent Reporters

You Know What’s Awesome? Being Able To Turn Regular Rent Payments Into A Credit-Building Opportunity. With Rent Reporting, You Can Add Monthly Rent Payments To Your Credit Report, Highlighting Yet Another Positive Aspect Of Your Financial History. The Best Part Is Boom Will Pull In Up To 2 Years Of History. This Helps Those With Limited Age On Their Credit Reports. For Some, This Can Add Up To 40 Points To Credit Scores.

Credit Cards, Loans & Bank Products

Debt Consolidation Loans

Say hello to Debt Consolidation Loans! Merge those debts into one manageable monthly payment, supercharging your financial journey. If your goal is to pay your debt off more quickly, a debt consolidation loan may be for you. Start paying more than interest only on your debt. Compare the options available to you based on the amount of debt you want to payoff, credit score and more. The best part is there is no hard inquiry! Don’t miss out—explore your options now and pave the way to financial freedom.

Savings Accounts

Boosting your credit score is like unlocking a treasure chest of savings! It leads to lower interest rates on loans and credit cards, reduced insurance premiums, waived utility deposits, and even better rental deals. With good credit, you’ll keep more money in your pocket and watch your savings grow! as you work on improving your credit score, you not only enhance your financial health but also unlock various opportunities to save money in the long run. It’s a win-win for your wallet and your financial future!

Credit Cards

Are you missing a credit card from your credit report? Remember, a credit card can influence so many aspects of what makes your credit score. Explore our credit card comparison chart, which has both secured or unsecured cards suitable for all credit levels, because you need a credit card to build and manage credit effectively! Whether it’s influencing your utilization ratio, making everyday purchases, or enjoying exclusive perks, we’ve got you covered. Find the perfect card for your journey and start benefiting today!

Checking accounts

Dive into the World of Checking Accounts! Our comparison chart helps you find the perfect account for your financial needs. Whether you’re looking for no-fee options, high-interest accounts, or digital banking convenience, we’ve got it all. Explore now and take control of your finances!

Auto loan purchase

Ready to Roll with an Auto Loan? Discover your perfect ride and see how your credit score can open doors to more options. As you improve your credit, watch your choices expand for lower rates and better terms. Get behind the wheel of your dream car – explore our auto loan options today!

Auto loan refinance

If you’ve been boosting your credit score, it might be time to explore auto loan refinancing. As your credit improves, you can unlock better rates and save big on monthly payments. Don’t miss out on potential savings – check if refinancing is your ticket to a smoother ride!

Auto insurance

Rev Up Your Savings with Auto Insurance! Our comparison chart helps you find the perfect coverage for your wheels. Plus, remember, your credit impacts your insurance rates! As your credit score climbs, enjoy the potential for lower premiums and bigger savings. Secure your ride and your finances – explore our auto insurance options today!

Affiliate Advertising Disclosure

Credit Score Pro, LLC and its DBA, Credit Score Pro “Credit Score Pro” is a business providing software and financial products and other popular products and services on a commission basis. Commission may be per click, per lead, per sale, or other possible arrangements. This website may include only offers that provide compensation, but may also provide offers that do not provide compensation and we do not provide a complete list of products that may be available in this industry. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Our partners also receive commissions for market these products. Our partners have their own privacy policies, terms and conditions, and disclosures. All product details on this site and our partner sites are presented without warranty. Reasonable efforts are made to maintain accurate information in this website. Terms and conditions for each offer is available on the advertisers secured application page.